Powerball Analysis

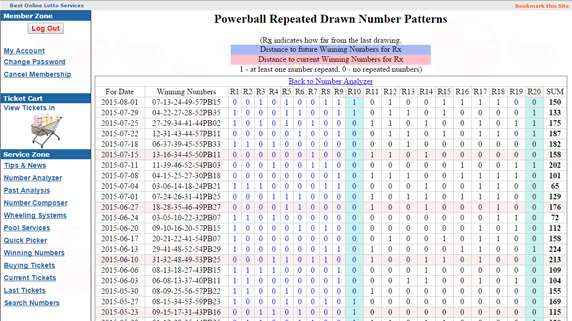

Powerball Frequency. Presented below are the latest Powerball Frequency charts that are updated immediately following each draw.The frequencies were reset following the Powerball changes that took place on October 7th, 2015.The frequency of each main number and each Powerball are presented in a tablular form for you to easily check a number of your choosing. These are the latest New York Lottery Results from the biggest and most profitable lottery in the entire USA. You’ll find results for all the NY Lotto games including Win 4, Numbers, Quick Draw, Pick 10, Take 5 and, of course, not forgetting the state’s very own New York Lotto. PowerBall uses 5 balls ranging from 1 to 69 followed by a sixth PowerBall ranging from 1 to 26. This historical analysis spans the current PowerBall configuration with 25 drawings spanning from November 11, 2020 through the drawing on February 3, 2021. PowerBall uses 5 balls ranging from 1 to 69 followed by a sixth PowerBall ranging from 1 to 26. This historical analysis spans the current PowerBall configuration with 25 drawings spanning from November 11, 2020 through the drawing on February 3, 2021.

This deep Analysis of Powerball lottery Jackpot will give you a clear idea about how much money you get and how much will be the tax deduction. There are two options you can choose to get your winnings, One is Annuity and second is cash. If you choose annuity then you will get the amounts in 30 parts for next 29 years. The first part of the annuity you will get right away when you claim your jackpot and the next 29 amounts you will get for the next 29 years. Breakdown of Powerball Jackpot's annuity payout is listed down below.

The cash amount is a lump sum amount that you will at the time of claim. This cash amount is going to be the full and final amount paid at once. This amount will be less than the actual Jackpot amount because of the tax deductions. Federal and State taxes might be deducted initially by the lottery and then the remaining amount you will get in your pocket. So your final payout will be something approximately 40% less.

You might need to pay some local taxes in your region if the government imposes those on you. It may be for some charity or donation. You can't deny paying this tax.

If you choose annuity payments, then you have to pay all the taxes each year on the gross amount for that particular year.

If you are already earning much apart from the lottery jackpot winning amount, then you may fall in higher tax rates. That is something very technical, so better to consult an expert in this matter.

Powerball Lottery Annuity Jackpot amounts Calculator

We have developed this calculator for you to analyze the Jackpot of Powerball. You have two options to get paid. One is cash payment, and that is a simple method to get your full Jackpot amount at once. There is a second option, which is an Annuity option, and in this, you can get your jackpot amount in 30 installments. When you are choosing the Annuity option, then you should be aware of how much money you will get each year. For you, this is going to get a hectic task to do it by yourself. So to help you in this situation, I have created this software to calculate the jackpot amount for you.

Powerball Analysis Calculator

You need to select the state in which you are residing or bought a lottery from there. And this analyzer will evaluate the jackpot and break it down in thirty parts. These 30 parts you will get for the next 30 years. It will automatically calculate the federal tax and the state tax for you and also deduct it from the gross amount and then show you the final amount.

Powerball Cash Option amount will be paid at the time of claim. To check the Cash Option amount you can use the following calculator.

Mega Million Analysis

Payout you receive first year will increase by 5% each year. You will have to pay state taxes separately according the the US state law. Federal tax is universal in whole US but state taxes are different for each state.

$56 Million Powerball Jackpot Annuity Breakdown

Current Jackpot amount is $56 Million, So we are going to break this into 30 parts, those are called as annuities.

| Year | Gross Amount | Federal Tax | State Tax (0%) | Final Amount |

| 1 | -$311,866 | $531,015 | ||

| 2 | -$327,459 | $557,565 | ||

| 3 | -$343,832 | $585,444 | ||

| 4 | -$361,024 | $614,716 | ||

| 5 | -$379,075 | $645,452 | ||

| 6 | -$398,028 | $677,724 | ||

| 7 | -$417,930 | $711,610 | ||

| 8 | -$438,826 | $747,191 | ||

| 9 | -$460,768 | $784,550 | ||

| 10 | -$483,806 | $823,778 | ||

| 11 | -$507,996 | $864,967 | ||

| 12 | -$533,396 | $908,215 | ||

| 13 | -$560,066 | $953,626 | ||

| 14 | -$588,069 | $1,001,307 | ||

| 15 | -$617,473 | $1,051,373 | ||

| 16 | -$648,346 | $1,103,941 | ||

| 17 | -$680,764 | $1,159,138 | ||

| 18 | -$714,802 | $1,217,095 | ||

| 19 | -$750,542 | $1,277,950 | ||

| 20 | -$788,069 | $1,341,848 | ||

| 21 | -$827,473 | $1,408,940 | ||

| 22 | -$868,846 | $1,479,387 | ||

| 23 | -$912,289 | $1,553,356 | ||

| 24 | -$957,903 | $1,631,024 | ||

| 25 | -$1,005,798 | $1,712,575 | ||

| 26 | -$1,056,088 | $1,798,204 | ||

| 27 | -$1,108,892 | $1,888,114 | ||

| 28 | -$1,164,337 | $1,982,520 | ||

| 29 | -$1,222,554 | $2,081,646 | ||

| 30 | -$1,283,682 | $2,185,728 |

Conclusion of Analysis

This complete analysis gave you a rough idea about how much tax you might need to pay. I have fixed federal tax to 37% because the Jackpot amount is always more than $20 Million, and that's the percentage for that much money.

State taxes I have mentioned might be different in your state, so you need to verify it from your end.

All the tax amounts mentioned here are just a rough idea by taking the Jackpot amount is the only source of income. So the final amounts may be different from the amounts mentioned above.

Some states in the US may deduct some amount from your jackpot for child care, or to help some NGOs.

Powerball Analysis Lottery

Powerball Calculator

State taxes may frequently change by the state governments to manage the revenue and cash flow. At the time of writing, all the state tax percentages are correct, but It may change anytime, and this data might be outdated. But we try to keep it updated always.